Stocks closed out the week not much changed with the S&P 500 finishing relatively flat. Trading was listless with investors having little else to focus on other than earnings. As of Friday, 88 of the S&P 500 companies had reported, of which 76% managed to beat analyst estimates. It should be noted that analyst estimates have been trending lower, so beating these estimates isn’t so much a function of companies outperforming as it is analysts having been overly conservative.

The Q1 2023 earnings growth rate is on pace for a -4.70% decline, quarter-over-quarter. Excluding the energy sector, earnings are even lower at -6.10%. Should earnings hold at this level through the end of the season, it will be the S&P 500’s second quarterly loss and the greatest quarterly decline since the onset of COVID in Q2 2020. Presently, the S&P 500 trades at an estimated 18.3x on a forward basis, slightly below the five-year average of 18.5 but above the ten-year average of 17.3. The S&P 500’s present valuation is being supported by the market’s belief that the Fed will soon cease its rate tightening campaign, but the current valuation is hardly compelling given that we expect economic headwinds to strengthen as 2023 progresses.

Elsewhere, readings from the housing sector remain mixed. Builder incentives continued to attract new homebuyers as permits for single-family new construction surged in March, hitting a five-month high. Ground-breaking on new homes rose 2.70%, a three-month high. Meanwhile, existing home sales unexpectedly fell -2.40% in March as a sharp pop in mortgage rates zapped homebuyer demand. On an annual basis, existing home sales were down -22% relative to March 2022 while the national median existing home price declined by -0.90%. Surprisingly, this was the largest year-over-year (YOY) price decline since January 2012.

Final Thoughts

It was an uneventful week as markets treaded water with the Fed’s FOMC meeting still two weeks away. Both this week’s data and corporate earnings continue to point to a truly mixed bag for the economy and markets by extension. Of the 11 S&P 500 sectors, five are expected to report higher earnings on a YOY, quarter on quarter basis (consumer discretionary, energy, healthcare, industrials, utilities), five are expected to decline (financials, technology, materials, communication services, real estate), and one is expected to be flat (consumer staples). With earnings contracting, investors have thus far been content to look beyond any near-term dip and embrace a potential recession as a fixer for both inflation and an aggressive Fed.

The end of a rate tightening campaign has typically been a strong, positive catalyst for markets, which is something investors have been pinning their hopes on since January. The Fed’s willingness to pivot, however, is data dependent. Every data point released this week supporting the pro-pivot case was followed by another suggesting the opposite. Monday’s sizzling Empire State Manufacturing Index was parried by a poor Philadelphia Fed Manufacturing Index reading on Thursday. The Leading Indicator Index reading, a composite of 10 forward looking metrics, flashed future weakness but it was contradicted in Friday’s PMI readings that showed goods and services remain in strong demand. While the overarching trend has been towards moderation, that moderation has yet to translate into a degree of weakness – particularly at the consumer level – that the Fed would consider satisfactory. Consumer staple producer Proctor & Gamble commented during their earnings call that they continue to see the U.S. consumer holding up well, so well in fact that it allowed the company to raise prices by 10% during the most recent quarter (more than offsetting a 3% volume decline). Similar observations have been echoed throughout this season’s earnings calls with those companies experiencing reduced sales commenting that the demand has simply shifted to alternative products or away from products altogether and into services. With consumer discretionary and industrials continuing to post solid performances, it seems unlikely inflation is going to fade away smoothly and that the Fed’s 25 bps hike at their next meeting will be their last as markets presently expect.

The Week Ahead

Next week, we will take a look at Q1 GDP, personal income and spending, and the PCE Index

Probity Advisors, Inc. 2023 Planning Guide Now Online

To meet the evolving needs of our clients, Probity Advisors, Inc. has launched a newly redesigned client portal. The portal provides a more engaging and modern online client experience to investors, enabling clients to have flexible and transparent tools and insights for a comprehensive view of their financial lives. Below is a summary of some of the features of the portal, and we encourage our clients to reach out to us with any questions:

- Goal Tracking – Connect your specific planning goals to investment accounts in order to chart your progress towards achieving multiple financial goals.

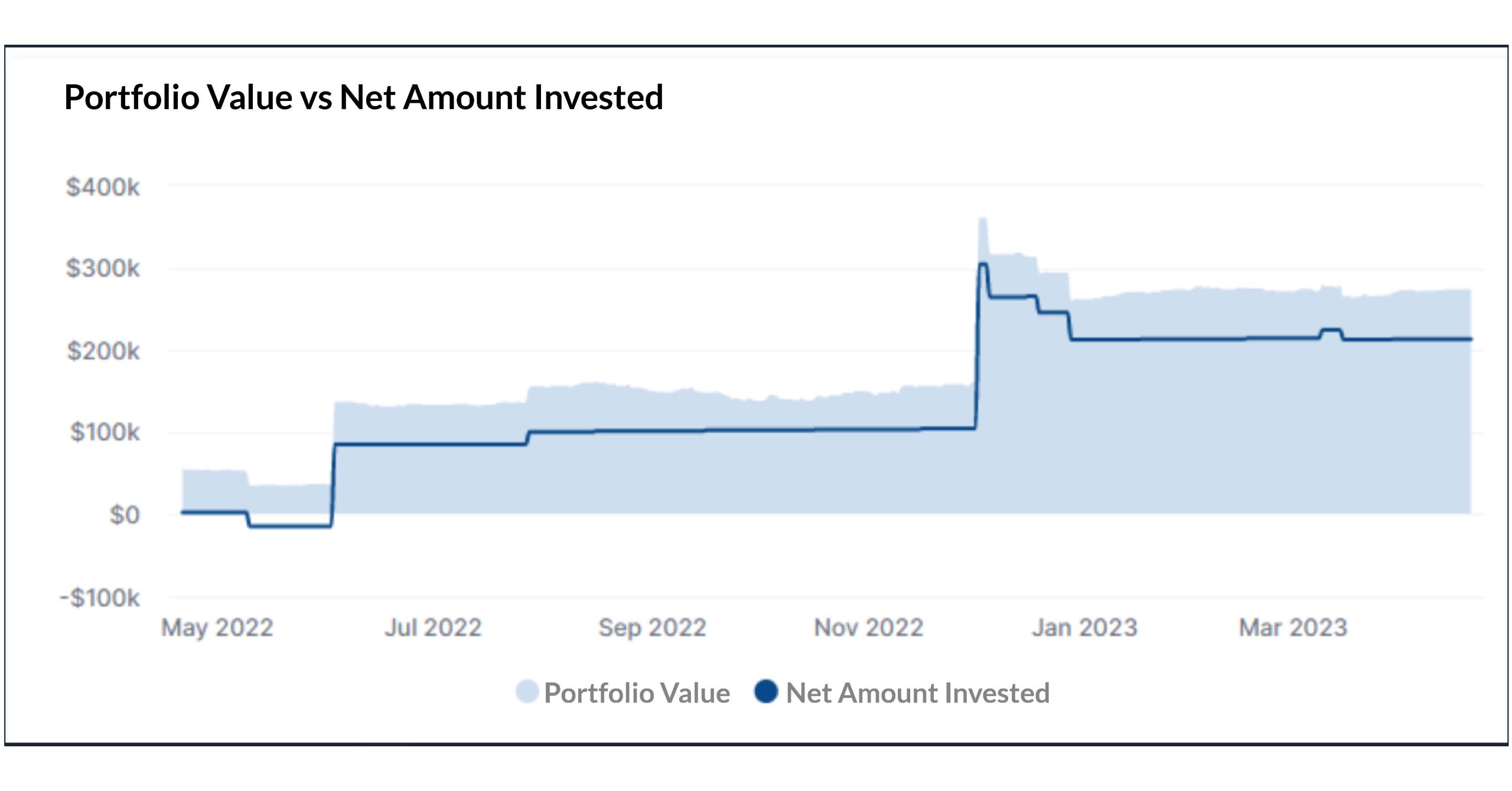

- Transactions – View transaction summaries that are updated daily, including beginning market value, contributions, distributions, and market value changes for investment accounts.

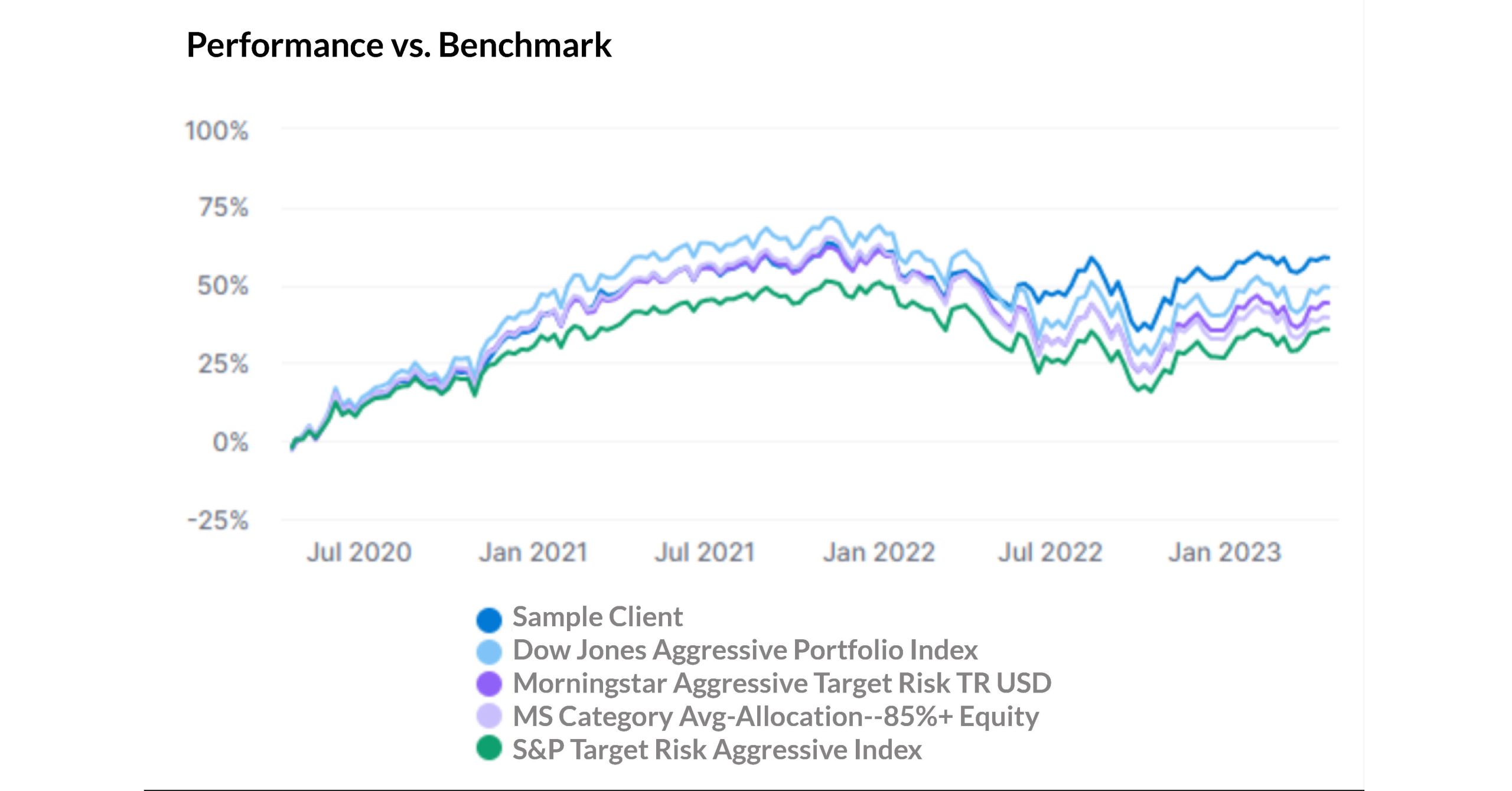

- Performance – Create historical performance reports with the flexibility to choose month-to-date, year-to-date, 1-year, 3-year, 5-year snapshots and beyond or view accounts within a custom date range you select.

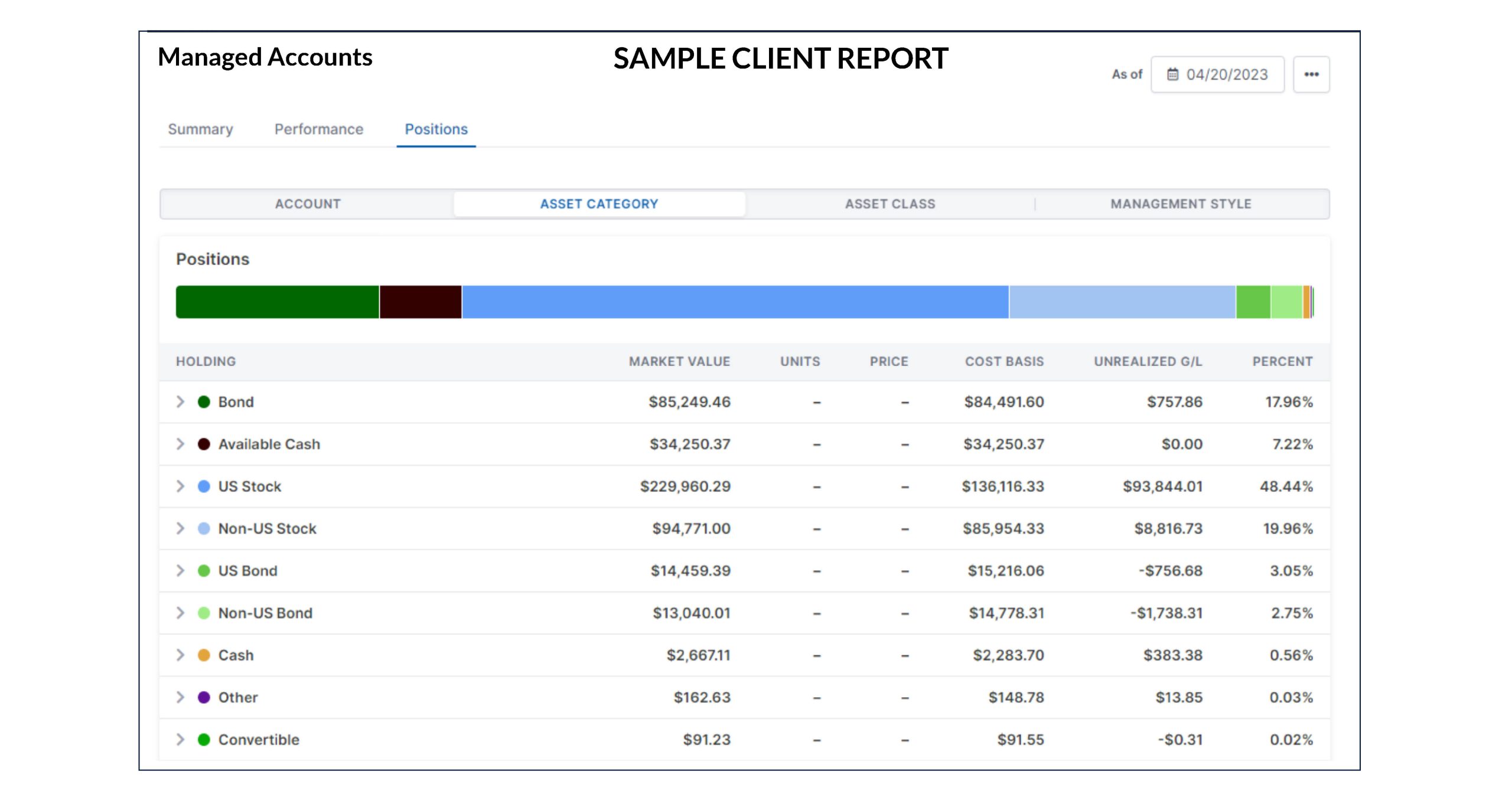

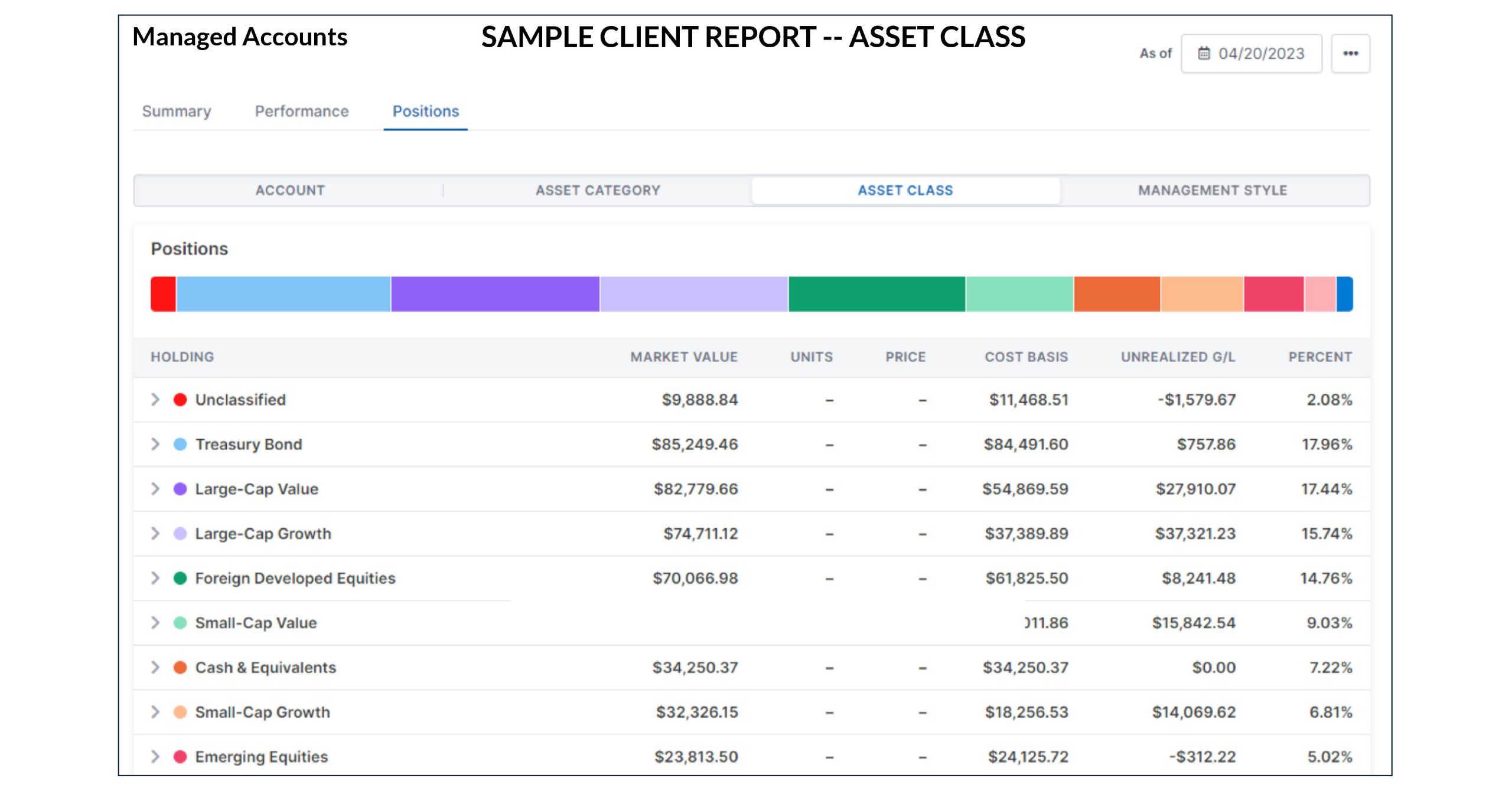

- Account Aggregation – Compare individual account values to view progress for single accounts or view an aggregate, up-to-date snapshot of all accounts held by you and accounts held across your household.

- 360 Degree View – Link other financial accounts such as checking and savings accounts, assets such as real estate, and debt and loans such as mortgage balances for a holistic and comprehensive view of your financial situation.

- Document Storage – Take advantage of a secure, one-stop storage site for important documents that allows quick and easy access to wills and trusts or other estate planning, legal, and financial planning documents all in one location for ease, peace of mind, and convenience

The data on the Probity Advisors, Inc. client portal is available to our investors at all hours of the day or night to give clients real-time access to important information. Our goal is to offer usable and useful tools and resources in a one-stop experience where clients can view their entire financial picture. Below are some of the charts and custom reports available on the new client portal.