March 13, 2020

Bull Market Dies From Severe Case of “An Abundance of Caution”

A vacuum of political leadership, a botched mobilization effort by the CDC, a lack of coordinated global monetary and fiscal response, and the continuing spread of COVID-19 put a stake in the heart of history’s longest bull market this week. It was an incredibly volatile week, that included the worst single day’s performance for markets since 1987. Markets have been on edge for the last month over the potential economic fallout as businesses and consumers have begun adopting greater and greater social distancing measures. Matters were made worse on Monday, however, when investors were greeted to news that Russia and Saudi Arabia had engaged in an oil production war – one aimed at bankrupting the already weakened U.S. shale industry. The stacking of health and economic concerns was simply too much for this old bull’s back to take, sending the S&P 500 crashing nearly -8.79% for the week.

Consumer Prices Hold Steady as Producer Prices Fall

The full effects of the coronavirus have yet to be felt, but we’re starting to see some inflections. U.S. consumer prices held relatively steady in February, up 0.10% for the month. Year-over-year (yoy), consumer prices were still up a healthy 2.30%. Excluding volatile food and energy, prices were up 0.20% in February and up 2.40% year-over-year. A drop in airline fares and gas helped offset a rise in clothing, used cars, and medical care. While consumer prices held steady, producer prices fell by the most in five years in February. A drop in the cost of goods such as gasoline and services served to push producer prices down 0.60% for the month. Year-over-year, producer prices are up a mere 1.30%, down sharply from January’s 2.10% yoy increase. Excluding the volatile food, energy, and trade services components, producer prices fell 0.10% month-to-month in February. The monthly drop lead core producer prices to a 1.40% yoy rise. The outlook for inflation remains very modest at best as we expect the drop in demand due to coronavirus concerns to more than offset any reduced supply from the disruption in production.

ECB Leaves Investors Wanting More

The ECB announced it would hold interest rates steady at -0.50%. It also announced a range of measures to provide cheap funding for eurozone banks to help them support the economy through the coronavirus pandemic. The central bank indicated it would provide major funding facilities for eurozone banks to help them keep lending to struggling companies hit by the virus. On top of that, the ECB announced it would be boosting its current bond-buying program by $133 billion, adding to its $2.9 trillion bond-buying program. The additional bond-buying will primarily be used for buying private sector debt. ECB President Christine Lagarde also hinted the ECB could use “all the flexibility” in the rules it set for itself for quantitative easing. This suggests the ECB could increase the proportion of Italian bonds in its portfolio in order to alleviate the market’s pressure on the country. Despite these measures, investors were left disappointed as the central bank opted not to cut interest rates further. The central bank remains hesitant to further cut rates as the move would deliver yet another blow to eurozone banks which need to keep liquidity flowing to businesses during the coronavirus pandemic.

Clearly, this week was historical and not in a good way when it comes to our clients’ net worth. We’ve managed assets in all sorts of market conditions, and while each market crash is unique in what triggers it or what underlies it, there are certain commonalities we, as managers, experience when the market hits its panic levels. The first thing that happens is we fall back on reminding ourselves what is real and tangible. Multiples contraction, supply chain disruption estimates, the economic impact of social distancing, and the risk of oil patch bankruptcies creating a credit crisis are all risks. The market is obsessing over these issues and many more, and while they have real implications, they are abstract and non-quantifiable at best. What is real? We ask ourselves these absurdly basic questions. The answers are equally basic. We have to consume to survive – so that’s real. Companies will have to produce these goods – so earnings are real, and if we throw out all the fancy financial models and just go back to basic algebra, we are reminded that the value of an asset is simply the present value of all future cash flows. If that is the case, then one can value the market because it is derived from the present value of all future earnings, making it real.

We don’t set the price of the market, however. That is dictated to us each day and each moment. What we can do, however, is reverse engineer the price of the market, using assumptions on earnings that we are comfortable with, in order to determine just how rationally or irrationally the market is behaving. We can determine the required rate of return implied by the current market price to determine if that required rate of return is above (implying undervalued market) or below (implying overvalued market) long term average returns. An even better way of getting comfort in times of panic is to use the market’s current price but manipulate the implied assumptions used by the market in reaching its current price in order to see how extreme the assumptions are relative to what is realistic. That is a mouthful, but it is incredibly basic and a simple example will illustrate our point.

First, our assumptions. This is our basic belief set. We believe COVID-19 is a health crisis not a financial crisis. As such, we believe the earnings impact will have a large impact on 2020 and potentially 2021, after which earnings grow at the low end of historical norms. We assume a 5.75% average, long term earnings growth which is conservative considering that the rolling, 10-year average growth rate has been 8.23% on the S&P 500’s operating earnings from 1988 to 2019. We are using 2500 for the price of the S&P 500, which is approximately where we closed on Thursday (3/12).

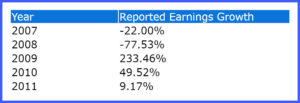

The first thing we did was to calculate the implied required rate of return for the current market assuming an experience similar to 2007-2011. Below is a brief summary of the earnings growth for the S&P 500’s reported earnings. The Financial Crisis was an extreme event, striking at the heart of our financial system. While COVID-19 will have a major impact in the near term, we believe the earnings rebound and earnings visibility is far more certain than what we experienced from 2007-2011, with the notion being that if we could get comfortable with the implied required rate of return assuming a 2007-2011 like earnings impact, then we should feel very comfortable about our downside risk given that we think we are unlikely to experience such an extreme event in reality.

What we find is that with the S&P 500 at 2500, this implies a required rate of return of approximately 9.5-10% annually. Considering that a) this is slightly above the long term average for markets in general and b) we have applied what are seemingly very conservative assumptions, we believe 2500 represents real value. The next thing we did was to do the same exercise using Goldman Sach’s estimates including the impact of coronavirus. Goldman has been one of the more bearish firms when it comes to revising their estimates in lieu of COVID-19, estimating that earnings will decline only -0.16% in 2020 before rebounding 11% in 2021. Here again, we use our 5.75% long-term growth estimate for 2022 and beyond. When you do this math, a 2500 value on the S&P 500 implies a 11.8% annualized required rate of return. We don’t know many folks who wouldn’t jump on that opportunity if it weren’t for the fact that it was happening in the midst of a panic. Our point is not to try to call a bottom. Goldman thinks this could go to 2300. The point is to remind ourselves that there is huge value at these levels.

After we get a sense of reality, the next question we ask ourselves is what can we do. It is rarely the case that an investor is just sitting on a pile of cash when these crashes occur. Normally, investors are fully invested in their asset allocations when these outlier-type events occur. That being the case, there are a number of things investors can do, or that we do on their behalf, to take advantage of the opportunity that is being presented. Since our client asset allocations are diversified, this means that these declines may impact significant parts of the portfolio but not the entire portfolio. As a result, these declines mean the portfolios get out of alignment with their target allocations. By rebalancing, selling out of the buffered part of the portfolio and buying into the beaten up asset classes, we are increasing our exposure to the undervalued securities in order to better position the portfolio when markets turn around. Furthermore, within each of the asset allocation targets themselves, we may get tactically more aggressive. For example, we may lower our overall bond exposure and increase our overall equity exposure while still staying true to the particular risk definition the client has elected. You may think of this as skewing the portfolio to the higher end of the acceptable range for the particular risk level. Lastly, we think it is important to have conversations with our clients about whether or not it makes sense for them take on additional risk. While it is hard to imagine wanting to expose yourself to even greater risk having traversed the ranges in the market we’ve seen recently, for investors with longer time horizons this type of strategy may make sense.

The final thing we ask ourselves is whether we are being credible and transparent with our clients. A large part of our job is to help coach our clients to the tenets of long term investing, but no one respects a captain that tells you to remain calm when the ship is clearly sinking. We don’t know when this bear market will bottom. The math tells us the market is cheap but that doesn’t mean it doesn’t get cheaper. People can behave irrationally, and we think the market is in that zone now. In the midst of this week’s panic, there was a comment that just kept reverberating in our minds over and over. It was made by Josh Brown, an analyst at Ritholtz Weath Management. To paraphrase, he said, “the theme or phrase for 2020 will be ‘out of an abundance of caution'”. Schools will close out of an abundance of caution. Stadiums and sporting events will close out of an abundance of caution. Commerce will be disrupted out of an abundance of caution. Ultimately, this bull market has died out of an abundance of caution. Hearing this was an epiphany of sorts and incredibly comforting as a long-term, value investor. Inherent in the comment is the idea that, to the degree we end up dipping into recession as a consequence of social distancing, this is entirely self-imposed and entirely reversible. This is a temporal and not structural challenge and when you put that with today’s valuations, the world seems a lot more sane.

The Week Ahead

Traders will be closely tuned in to the Fed’s FOMC meeting to see if they announce further measures to tackle the coronavirus. We’ll also get our first economic reports on consumer spending post-coronavirus outbreak with reports on retail sales, existing home sales, and homebuilding.

An Ounce of Prevention

You have likely heard from individuals and organizations you interact with about steps they are taking in light of the coronavirus and the current public health environment. While we don’t know exactly what will happen over the coming weeks and months, there appears to be consensus among experts in the medical community that the spread of the virus will likely continue for the foreseeable future. Facing this reality, we tend to agree with the old saying that an ounce of prevention is worth a pound of cure.

We want to reassure all of our clients that we are currently keeping our doors open, and clients are welcome to visit us. We are also taking precautions and have robust response plans and procedures in place to continue to operate. We don’t want to unwittingly expose anyone so we will temporarily be limiting visitors to our office to clients and staff only.

If you prefer the comfort and convenience of staying home while staying in touch with your advisor, particularly during this time of uncertainty, we are happy to facilitate a video conference as an alternative to an in-person meeting.

Our employees are taking appropriate preventive measures. This includes regular and consistent hand washing along with the use of hand sanitizer and disinfecting spray and wipes. Our associates have been asked to practice prudence and proper social distancing techniques. Social distance decreases the chances of becoming infected with a virus by limiting the number of people a person comes in contact with. We are also encouraging any associates who do not feel well to stay home and those who may have traveled to be mindful prior to returning to the office. These actions are being taken preemptively to decrease exposure and prevent transmission.

Our building is currently implementing additional cleaning protocols with an emphasis on “touch points,” public areas and surfaces that more than one person may touch. They have increased the cleaning frequencies of these areas along with the use of disinfectants where appropriate.

We will continue to do what we think is in the best interest of our clients, our staff, and our community, and we will continue to monitor the situation and recommendations from medical professionals. Should the need arise, we are prepared to implement policies and procedures that enable our staff to remain home and safe while continuing our operations seamlessly and efficiently. We will communicate any changes to our practices and procedures to you as needed.

It is our duty to serve our clients with the utmost care and concern, and we are addressing this health situation with the same principles of preparedness that we approach the guidance we provide to our clients. We are taking these actions out of an abundance of caution and to be prudent and responsible corporate citizens.

We appreciate all of our clients and are grateful for the trust you have placed in us. If you have any questions, please call our office at (214) 891-8131.