January 29, 2021

It was a wild trading week on Wall Street as a flash mob of Reddit traders faced off against hedge funds in a battle that has been brewing over several weeks. Amateur traders have taken to online trading boards, sniffing out hedge funds’ top short positions (GameStop, AMC, and Blackberry) in hopes of rallying sufficient investor demand to force hedge funds to buy back their losing short positions and send prices higher in these risky names. On Wednesday, the battle on the Reddit boards spilled over to the broader market as investors grew anxious hedge funds would be forced to liquidate long positions to raise cash in an effort to defend their short bets against the day traders. Concerns also grew that a scramble to sell shares could cause ripple effects throughout the financial markets, and lead to liquidity issues at brokers such as Robinhood. On Thursday, in response to the frenzied trading, brokers limited trading in these names in order to shore up their capital. In the case of Robinhood, it raised more than $1 billion from investors on Thursday evening and tapped its credit lines to ensure it had the capital required to allow limited trading again on Friday in these volatile names. With investors riveted by the trading battle between Redditors and hedge funds, they were quick to dismiss the week’s Q4 2020 GDP report, the Fed’s FOMC meeting, and personal income figures. For the week, the S&P 500 ended down -3.31%.

U.S. GDP Ends 2020 Up 4.00%

Fed Holds Rates Steady

Households See Incomes and Savings Rise

The Week Ahead

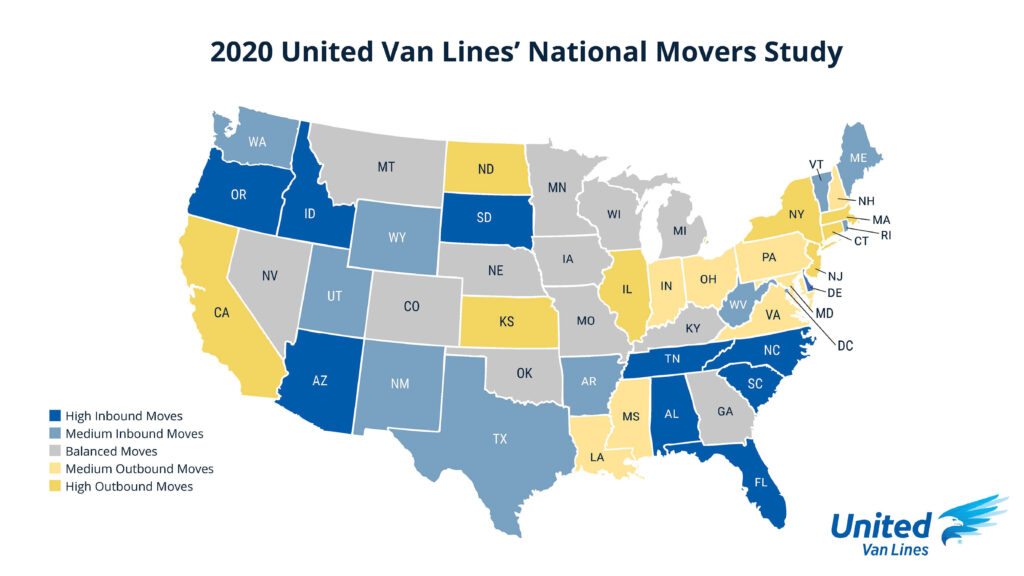

Americans on the Move

- Idaho

- South Carolina

- Oregon

- South Dakota

- Arizona

- North Carolina

- Tennessee

- Alabama

- Florida

- Arkansas

This year’s survey indicated 40% of Americans who moved did so for a new job or a job transfer. More than one in four (27%) moved to be closer to family which is significantly up over prior years. The pandemic has had a big influence on why people packed up and headed elsewhere. COVID was cited as influencing the decision to move by just 4.6% people in March and rose to 15.4% of people in October 2020. Among those who cited COVID as an influence for moving, the top reasons were:

- Concerns for personal and family health and well-being

- Desires to be closer to family

- Changes in employment status or work arrangement (including the ability to work remotely)

- Desires for lifestyle change or improvement of quality of life

- Desire to expand living space

- New Jersey

- New York

- Illinois

- Connecticut

- California

- Kansas

- North Dakota

- Massachusetts

- Ohio

- Maryland

The top three metropolitan areas ranked by increase in year-over-year outbound moves from 2019 to 2020 are the following:

- San Francisco-Oakland-Berkeley (California)

- Seattle-Tacoma-Bellevue (Washington)

- New York-Newark-Jersey City (New York, New Jersey, Pennsylvania)

The chart below shows an overview of state-to-state migration patterns, with the darker yellow indicating a greater exodus and the darker blue indicating higher inbound moves.