Charitable Giving Strategies to Save on Taxes

One tax saving strategy is the gifting of highly appreciated stock. This provides a two-fold benefit. First, you can enjoy an income tax deduction at your marginal tax rate, and second, you can bypass the capital gains tax that you would have otherwise owed if you cashed in the shares yourself in order to raise the cash for your donation.

Given that many charities enjoy tax free status, the gifting of highly appreciated stock results in the same benefit to the charity as if you had written them a check.

Consider this scenario:

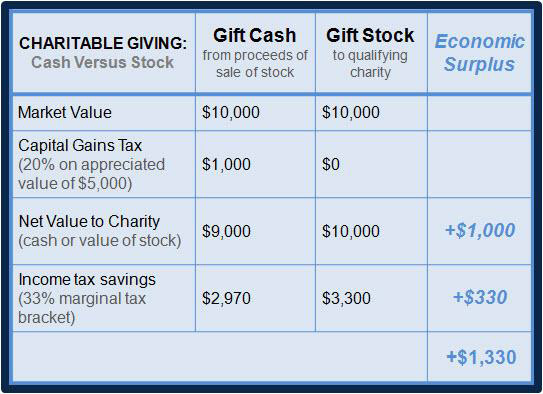

Say you want to donate $9,000 to your favorite cause. To fund your donation, you choose to liquidate some of your investment portfolio to raise the necessary proceeds. Several years ago, you bought 100 shares of XYZ stock for $50 per share, and it has now risen to $100 per share. In other words, your investment is now worth $10,000. The liquidation of those shares yields $10,000 from the sale but also triggers a 20% capital gains tax on the $5,000 capital appreciation. All in all, your donation yields $9,000 ($10,000 – $1,000 capital gains) to the charity, netting you a $2,970 deduction (assuming a 33% marginal tax bracket).

If you donate the shares directly to a charity, however, you get a deduction for the full $10,000 and pay no tax on the appreciated value from $5,000 to $10,000. As the chart below shows, by giving the shares directly to the charity, you avoid paying any capital gains tax, you get a $3,300 income tax deduction (again, assuming 33% marginal tax bracket), and the charity gets the full $10,000 value.

So, here’s the question, “Would you rather make a $9,000 or $10,000 charitable donation, and would you rather save $2,970 in tax or $3,300 in taxes?”

If you’d like to discuss charitable giving possibilities, please call our office. We’d love to help you maximize tax-saving strategies and make the most of your philanthropic intentions.

Tips & Strategies for Philanthropic Giving

— Charitable giving can help reduce your tax burden

— Gifts of appreciated assets directly to a charity generally provide a bigger tax savings than selling the asset and gifting cash

— Not all charitable donations are tax deductible

— Research the charity and be wary of those with similar sounding names

— Donations to 501(c)(3) tax-exempt organizations are eligible for tax deductions

— Review your giving strategy each year with your financial advisor to align with changes in your situation and with current tax law

They who give have all things. They who withhold have nothing.

— Hindu Proverb