Holy Guacamole!

May 31, 2019

In a light week for U.S. economic news, traders once again focused on the latest trade developments. The U.S. and China continued their trade spat with China firing the latest salvo by threatening to cut off rare earth material shipments to the U.S. which are critical to smartphones, electric vehicles, and wind turbines. China also said it would halt purchases of U.S. soybeans. Things got more interesting late Thursday when the Trump administration announced a new 5% tariff on Mexican exports. The new tariff hits everything from avocados to autos, and unlike previous tariffs that focused on trade grievances, this newest round of tariffs is a punitive response based on the administration’s belief that Mexico has done too little to stem the flow of illegal immigration to the U.S. The tariffs are set to go into effect on June 10 and could increase to 25% on October 1st if progress is not made towards deterring the flow of migrants. The news caught the market completely flatfooted, with global markets declining on Friday. U.S. economic news was relatively light this week with the April report on international trade and the second reading of Q1 2019 GDP being the only notable releases. The trade report showed a widening trade gap with U.S. exports declining faster than imports, while Q1 GDP was revised downwards slightly to 3.1%. In overseas news, China released official manufacturing PMI numbers which showed manufacturers continued to suffer from the U.S.-China trade battle. Still, it was trade concerns that were top of mind, leading to a -3.00% decline for the Dow for the shortened holiday trading week.

Tariffs Take a Toll on U.S. Exports

The U.S. trade deficit in goods widened in April to a seasonally adjusted $72.1 billion from $71.9 billion in March. A -4.20% drop in exports was the primary culprit in the widening trade gap. Automobile exports saw the sharpest declines, falling -7.20%, while capital goods such as aircraft, farm and construction machinery, and washing machines fell by -6.50%. Imports also fell during the month, slipping -2.70% to $206.7 billion. Capital goods and auto imports also posted declines, down -3.50% and -3.10%, respectively. Although the U.S. had posted healthy export growth despite the tariffs to this point, this latest report shows new evidence that they are now beginning to weigh on orders. This will be exacerbated for autos in particular now that the administration has announced a new round of tariffs on Mexico.

China’s Factories Slip

China’s official manufacturing PMI fell to 49.4 in May from 50.1 in April. Numbers below 50 indicate contraction in the manufacturing sector, while numbers above 50 indicate expansion. China PMI is among the most watched global economic indicators for signs of slowing growth in the Chinese economy and the impact from its ongoing trade dispute with the U.S. The new export orders index showed greater contraction, falling to 46.5 in May from 49.2 the previous month. New export orders have been contracting for a year now, indicating the impact from the trade war is accelerating and taking a toll on factory floor activity. Another key indicator of the Chinese economy, the employment index, fell to a 10-year low. The metric is closely monitored by Beijing due to its link between unemployment and social unrest. The weak report suggests China will likely enact new stimulus programs to counter the effects of the trade war.

The week’s early headlines focused on the U.S. and China trade battle, but by week’s end, the attention had turned back to the western hemisphere as the Trump administration slapped Mexico with new tariffs. Mexico is critical to the auto supply chain, and with U.S. companies importing $114.3 billion in autos and parts from Mexico last year alone, the administration’s actions are likely to have a sizable impact on the U.S. auto industry. Just a month ago, with the USMCA trade deal awaiting ratification and the possibility of a follow-on Chinese agreement on deck, the tariff impact to the U.S. consumer and economy looked reasonably contained. Now, with the negotiations with China derailed and the new, Mexican tariffs threatening USMCA’s ratification, investors are understandably unsettled, and May’s market performance reflects that. This new front, the weaponizing of tariffs for non-trade disagreements, is particularly disturbing not only because it threatens all the progress on trade made to date with Canada and Mexico, but because it introduces a new risk for markets – the risk that commerce will be impulsively wielded for political purposes. It is a slippery slope, and one not easily contained once desensitized to use. So be sure to go out and enjoy your top-shelf margaritas and tableside guacamole this weekend because they’ll be more expensive in about a week.

The Week Ahead

A big week for economic data with the latest on U.S. jobs and manufacturing.

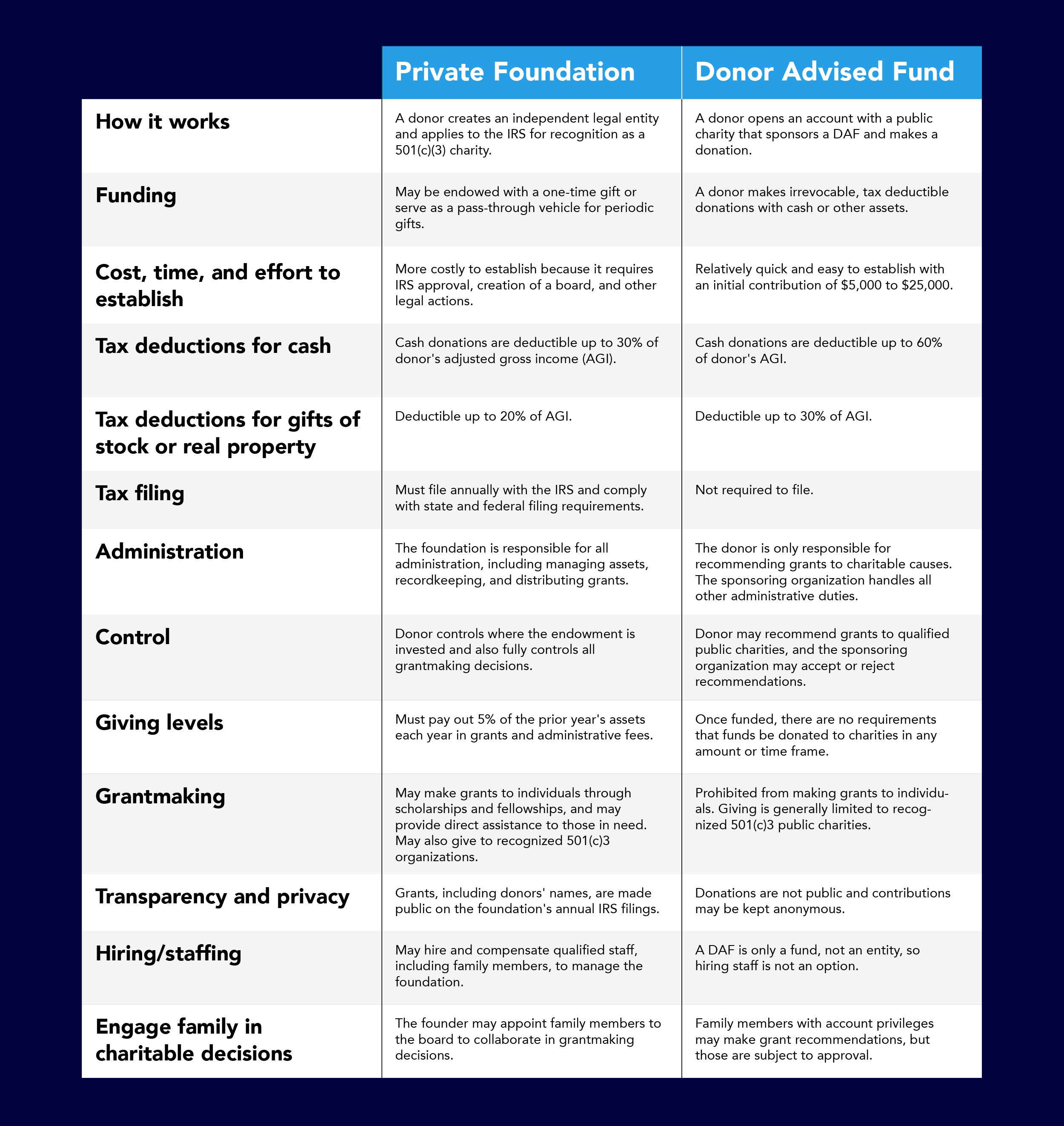

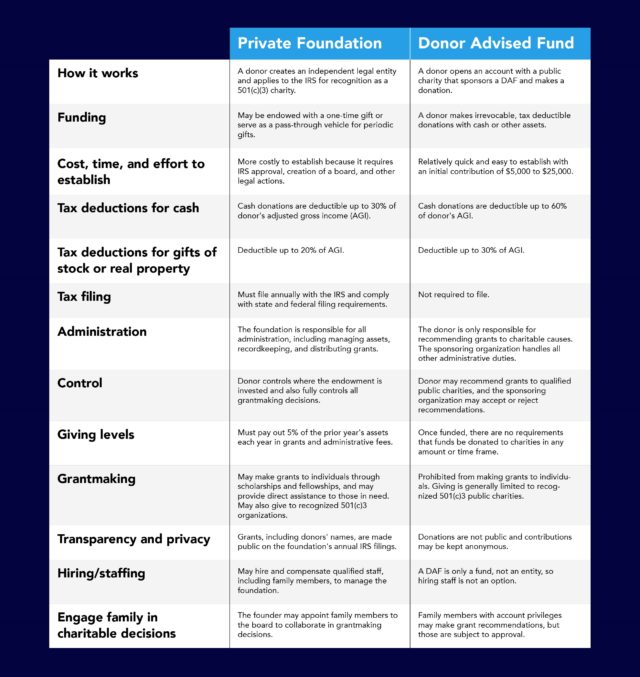

Creating a Structure for Charitable Giving: Private Foundation versus Donor Advised Fund

Many philanthropically inclined clients have asked our advisors about the differences between private foundations and donor advised funds (DAFs) for charitable giving. Both private foundations and DAFs can help donors achieve their philanthropic goals and create a lasting legacy. However, there are some significant differences between these two giving vehicles, including control over donations, entity structure, and tax benefits for donors.

A private foundation is a tax-exempt, freestanding legal entity usually founded by an individual, a family, or a corporation. Examples of some well-known private foundations include the Gates Foundation, the Ford Foundation, and the Getty Foundation. In a private foundation, the donor retains complete control over the funds and the grants. Once the foundation is established, the founder(s) may appoint a board of directors or trustees to help set foundation strategy, establish operating rules and procedures, and provide oversight. A private foundation may also hire and pay family members to participate in running the foundation. Private foundations are typically subject to more stringent regulatory oversight, including self-dealing rules, however, they offer more flexibility and control. Foundations are required to give out at least 5% of their assets each year to charity.

A DAF is a separately identified fund or account that is maintained and operated by a section 501(c)(3) public charity, which is called a sponsoring organization. Sponsoring organizations may be independent, community-based, religiously affiliated, or connected with financial institutions. To set up a DAF, a donor funds the account with an irrevocable, tax deductible contribution. The donor may make recommendations as to how the funds are invested and granted out, but the investment allocation and the way the funds are disbursed are subject to approval by the sponsoring organization, so the donor does not retain complete control. Major sponsoring organizations of DAFs include Fidelity Charitable Gift Fund and Vanguard Charitable. There are also single-issue DAFs such as The Sierra Club Foundation. DAFs have been growing rapidly in recent years, and there are more than 463,000 DAFs with a combined total of $110 billion in assets. In comparison, there are far fewer private foundations — an estimated 80,000 — but they hold significantly more assets with a combined total of $855 billion.

There is no minimum amount required for the creation of a private foundation, however, foundations are typically established with a large initial endowment due to the cost of establishing and operating the entity. The traditional guideline is a minimum investment of $2-$3 million, although donors may start with a more modest initial investment with the intent of adding funds later. DAFs are typically established with a smaller amount of anywhere from $5,000 to $25,000 and may be added to at anytime. Individuals interested in creating a long-lasting family legacy of philanthropy may be oriented towards a private foundation since the foundation allows for successive generations to participate directly in giving and in running the enterprise. Some DAF sponsoring organizations allow families to create an ongoing system of advising. Private foundations provide a level of control and flexibility not available through DAFs. Individuals interested in contributing smaller amounts, who prefer to give anonymously, or who desire simplicity in their philanthropic endeavors may be more interested in DAFs.

If you are interested in charitable giving, your advisor can help you determine if either of these two types of structures, or possibly a combination of the two, may be right for you. Below is a side-by-side comparison of some of the major differences. This list is by no means exhaustive, and we encourage you to reach out to us if you have any questions.