Here are the economic and market highlights for the week:

- Consumer prices rose 0.40% in March and were up 3.50% from the year ago period, topping estimates of 0.30% and 3.40%, respectively. Core CPI, which excludes volatile food and energy prices, rose 0.40% from the previous month while rising 3.80% from a year ago. Shelter costs drove much of the increase, up 0.40% month-to-month and 5.70% from the year ago period.

- Producer prices increased 0.20% in March, less than the expected 0.30%. However, on a 12-month basis, producer prices rose 2.10%, for their biggest gains since April 2023. A -0.10% decline in goods prices helped offset a 0.30% increase in services prices.

- Initial jobless claims dropped 11,000 to a seasonally adjusted 211,000 for the week ended April 6. That was below consensus estimates of 215,000 claims and below the four-week moving average of initial claims which smooths out weekly volatility of 214,250.

- The Q1 2024 earnings season kicked off on a down note Friday with JPMorgan Chase, the nation’s largest lender, reporting. The bank gave disappointing guidance saying its net interest income – a key measure of what it makes through lending activities – could fall short of Wall Street estimates for 2024. Despite JPMorgan’s weak start, data analytics firm LSEG expects a healthy Q1 2024 earnings season. They estimate that earnings will rise 5.0%. Excluding the energy sector, the yoy earnings estimate is 7.90%.

Inflation Data and Geopolitical Risks Conspire

The investor optimism that had propelled markets higher in the first quarter has hit a wall of worry now that we’ve entered Q2. The March CPI report released this week was the third consecutive reading showing that inflation continues to firm and it all but squashed hopes for a rate cut in June. While the PPI report released on Thursday was significantly tamer, it too showed an acceleration in pricing, and its release – coming on the back of Wednesday’s CPI report – was not great. Neither of the inflation readings, nor the market’s reaction to them, comes as any great surprise. All the precursor data (jobs, earnings, PMI) had suggested that progress on inflation had stalled, and investors have been wildly optimistic over rate cuts despite repeated calls from central bankers for patience. September currently seems to be the most probable timeframe for when the Fed might cut. Attention will now turn to earnings season.

Dip buyers came out on Thursday to take advantage of the week’s volatility, but investors did not like what they heard from JPMorgan Chase and Wells Fargo during their earnings calls on Friday. Despite both banks beating on the top line and earnings, investors focused on the negative impact rising interest rates had on their net interest spread as short-term rates rose (what banks pay) relative to the rates at which they lend. It should be noted that JPMorgan’s CEO, Jamie Diamon, has been a perennial bear on the prospects for a soft landing since 2022, so while his comments compounded the negativity already circling in the market, they were nothing new. The more impactful news on Friday was a report from the Wall Street Journal that Iran was planning a direct strike against Israeli interests – and perhaps Israel itself. If true, this would be a big escalation in events. This sent oil prices surging and caused domestic equities to fall. Should cooler heads prevail, and the geopolitical risk subsides, investors will be refocused on earnings next week with a raft of reports from banks, insurers, advertisers, transporters, and homebuilders set to be released. The reports from a broader array of industries is likely to temper the disappointment from this week’s initial round.

The Week Ahead

Next week, we will take a look at the following data:

- Retail Sales

- Existing Home Sales

- Q1 2024 Earnings

Tax Day and Contribution Reminder

Monday, April 15th is Tax Day which marks the deadline to file and pay taxes as well as make IRA contributions for the 2023 calendar year. Due to state holidays, taxpayers in Maine and Massachusetts have an April 17th due date to file and pay or to request an extension.

Around 19 million Americans are expected to request an extension for their federal taxes, asking for additional time to file their returns. Most taxpayers who owe money are still expected to make a payment to the IRS by April 15th because requesting an extension only allows additional time to file a return but does not grant additional time to pay taxes that are due. Special rules apply for tax deadlines for certain individuals, such as taxpayers affected by a natural disaster and those serving in a combat zone or qualified hazardous duty area. Individuals should consult with a tax advisor to determine if they qualify under these types of circumstances.

The consequences of not paying taxes on time are high: interest and penalties begin accruing immediately. Taxpayers will owe not only the amount that is due, but they will also owe interest on their unpaid balance. Interest and late fees can add up. Individuals who miss the tax-filing deadline without requesting an extension face a failure-to-pay penalty at 5% of the unpaid taxes for each month or partial month, capped at 25% of the total.

Patriots’ Day, Patriot’s Day, and Emancipation Day

As mentioned above, taxpayers in Massachusetts and Maine have an additional two days to file their taxes due to a holiday known as Patriots’ Day which commemorates the start of the American Revolution, marked by the battles of Lexington and Concord that kicked off the colonists’ fight for independence from Great Britain. Originally recognized on April 19th, the holiday also commemorates the anniversary of the Baltimore riot that occurred on April 19, 1861, an event commonly known as the first bloodshed of the American Civil War. In 1897, the Boston Marathon was added as part of the celebration of Patriots’ Day. In 1969, the entire celebration shifted to the third Monday in April to create a three-day weekend. Maine began celebrating Patriot’s Day (with a different apostrophe placement) in 1907, 13 years after Massachusetts. It’s an official holiday in both states, and since Tuesday, April 16th is Emancipation Day in Washington, DC, the tax deadline for these two New England states will fall on April 17th. Emancipation Day commemorates when President Abraham Lincoln signed into law the bill that abolished slavery nationwide, and legal holidays in D.C. affect the federal tax calendar.

Max Out Retirement Savings Accounts by April 15th

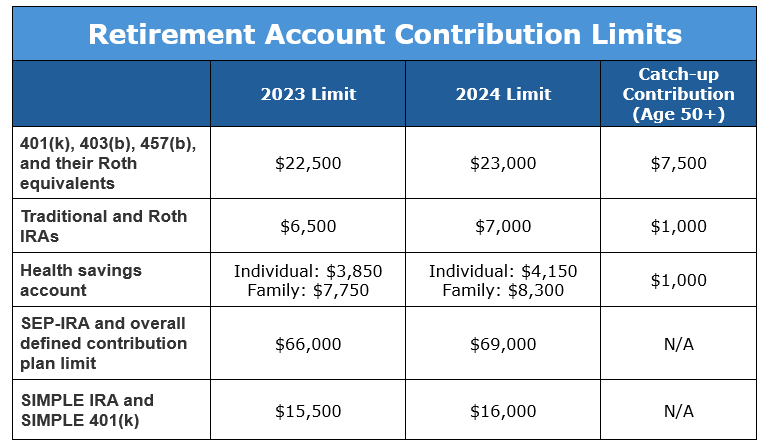

April 15th is also the deadline to make contributions to retirement accounts for 2023. Individuals who haven’t maxed out their retirement accounts can make contributions until the end of the day on Monday, April 15, 2024. Individuals can also make contributions for 2024 from January 1, 2024 until Tax Day in 2025, which provides a roughly 3.5-month overlap for making prior and current year contributions. Below are the contribution limits for various types of personal retirement plans for 2023 and 2024.