January 29, 2021

It was a wild trading week on Wall Street as a flash mob of Reddit traders faced off against hedge funds in a battle that has been brewing over several weeks. Amateur traders have taken to online trading boards, sniffing out hedge funds’ top short positions (GameStop, AMC, and Blackberry) in hopes of rallying sufficient investor demand to force hedge funds to buy back their losing short positions and send prices higher in these risky names. On Wednesday, the battle on the Reddit boards spilled over to the broader market as investors grew anxious hedge funds would be forced to liquidate long positions to raise cash in an effort to defend their short bets against the day traders. Concerns also grew that a scramble to sell shares could cause ripple effects throughout the financial markets, and lead to liquidity issues at brokers such as Robinhood. On Thursday, in response to the frenzied trading, brokers limited trading in these names in order to shore up their capital. In the case of Robinhood, it raised more than $1 billion from investors on Thursday evening and tapped its credit lines to ensure it had the capital required to allow limited trading again on Friday in these volatile names. With investors riveted by the trading battle between Redditors and hedge funds, they were quick to dismiss the week’s Q4 2020 GDP report, the Fed’s FOMC meeting, and personal income figures. For the week, the S&P 500 ended down -3.31%.

U.S. GDP Ends 2020 Up 4.00%

The U.S. economy continued to expand in Q4 2020 despite tighter operating restrictions to combat the winter surge of Covid-19 and a delayed pandemic relief bill. For the quarter, GDP rose 4.00%. Growth was driven by an increase in consumer spending, exports, residential investment, and private investment which helped offset a reduction in government spending at the federal, state, and local levels. Despite what is expected to be a slow start to 2021 as the country struggles to contain the pandemic and roll out vaccines, the economy is expected to rebound strongly in the back half of the year.

Fed Holds Rates Steady

The Federal Reserve held to script by extending its easy monetary policy. Following its FOMC meeting this week, the Fed voted to keep benchmark interest rates near-zero and continue its bond-buying program. That should ensure cheap credit will continue to flow to businesses and households struggling during the pandemic. In its official statement, the Fed noted that economic activity had moderated recently due to COVID, particularly in sectors dependent on high social contact such as restaurants, hotels, and airlines. The Fed went on to acknowledged that the path for the economy remains highly dependent on the rate of progress in vaccinations and that the Fed remains prepared to utilize its full range of tools as it deems necessary. The central bank’s announcement was entirely anticipated, while Wednesday’s market sell-off accelerated following the release, this likely had far more to do with other factors than the Fed’s news itself.

Households See Incomes and Savings Rise

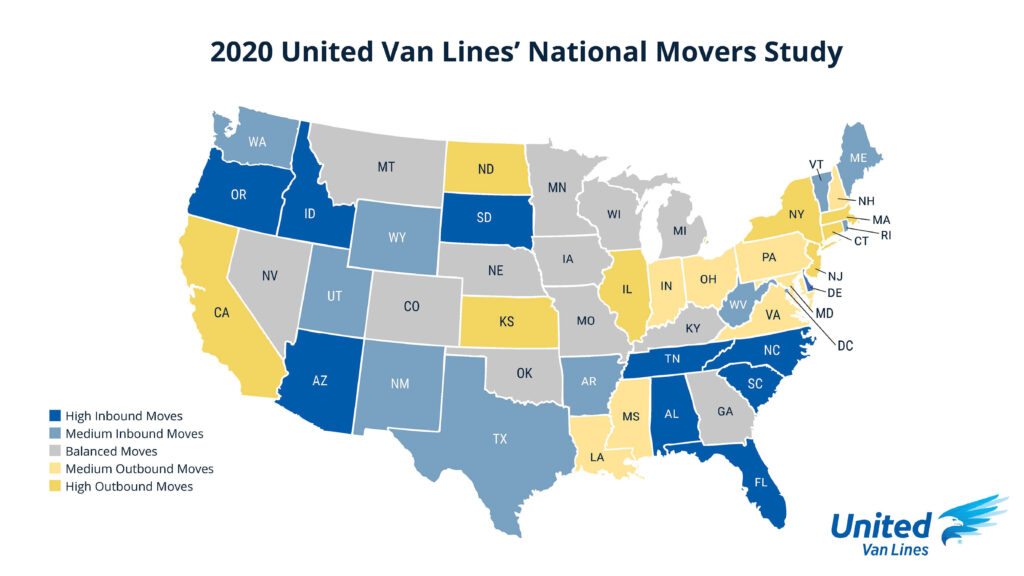

Americans on the Move

- Idaho

- South Carolina

- Oregon

- South Dakota

- Arizona

- North Carolina

- Tennessee

- Alabama

- Florida

- Arkansas

- Concerns for personal and family health and well-being

- Desires to be closer to family

- Changes in employment status or work arrangement (including the ability to work remotely)

- Desires for lifestyle change or improvement of quality of life

- Desire to expand living space

- New Jersey

- New York

- Illinois

- Connecticut

- California

- Kansas

- North Dakota

- Massachusetts

- Ohio

- Maryland

- San Francisco-Oakland-Berkeley (California)

- Seattle-Tacoma-Bellevue (Washington)

- New York-Newark-Jersey City (New York, New Jersey, Pennsylvania)