Here’s to 50 Years

January 8, 2021

Porter L. Ozanne, III

This week, we are thrilled to be celebrating the 50th work anniversary of Probity’s president and founder, Porter L. “Buddy” Ozanne, III. Buddy started his financial services career on January 2, 1971, and over the past five decades, he has helped innumerable families and individuals create and conserve wealth. He has also shared his wisdom and insights – both personal and professional – with his employees, clients, friends, and with countless students and professionals he has mentored over the years.

Those who know Buddy appreciate his warm and welcoming demeanor, his sense of humor, and his wonderful storytelling abilities, a trait we suspect he inherited from his father who loved sharing tales of his experiences as an officer in World War II.

To know Buddy is to know our firm. We wanted to dedicate this week’s communication to a Q&A with our founder, our friend, and our mentor as a way of honoring his milestone and sharing his journey and wisdom with others.

I understand you were an English major at SMU. How did you end up president of a financial services firm?

I was the first person in my family to attend college, and I always thought that earning the degree was more important than what I chose to study. My freshman English professor, Sandra West, was fabulous and encouraged me to become an English major because she thought that I had great “perspicacity.”

Have you always lived in Texas?

I am a native Texan. My mother grew up on her family’s cotton farm in North Texas. My father’s parents moved from Nashville, TN to Dallas in 1919 when my grandfather took a job with Pittsburg Plate Glass, a precursor to PPG Industries. I attended Southern Methodist University (SMU) and spent the summer after my freshman year in an internship in Boston where I worked the nightshift in the publishing house for the Christian Science Monitor. While I was an English major, it wasn’t like I was doing any editing or publishing. It wasn’t a glamorous job by any means, but I learned a lot about life in the summer of 1967. My apartment was located in the middle of Roxbury, the neighborhood that became the epicenter for the city’s protests. I made new friends from all walks of life who probably saved my life. It was the summer of student unrest over the Vietnam war, of the Roxbury protests, and of Stokely Carmichael’s march down Massachusetts Avenue. It was tumultuous times much like today. I am so grateful for the folks who took me under their wing and looked out for my safety. It shows the power of humanity and the importance of showing kindness and compassion to others. I think we could all use a lot more of that right now.

How and when did your father start his career in financial services?

My father, Porter L. Ozanne, Jr., worked in oil fields in Texas and Louisiana in the 1940s until settling down in Dallas and becoming a successful insurance agent and then opening his own agency, Ozanne and Associates. Back then, insurance was synonymous with financial services. Most people didn’t have a broker or a planner, but they had an insurance agent. He was really at the forefront of the evolution from such a singular focus on one aspect of a client’s financial life to providing comprehensive and ongoing financial guidance. My father worked long hours and six-day work weeks which instilled in me a strong work ethic and the importance of putting clients’ interests first. I often tagged along on some of his client meetings, and I saw from an early age the positive outcomes that my father’s financial advice provided individuals and families.

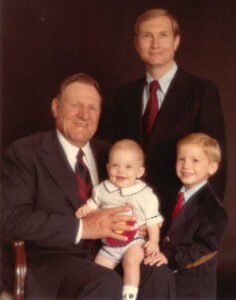

Buddy with his father and his two sons, Tyler and Sloan, c. 1980

You followed in your father’s footsteps. When did you begin working with him?

I joined Ozanne and Associates in 1971 and spent five years under my father’s tutelage before acquiring the business in 1976. Early on, we illustrated to clients the importance of proactively thinking about their financial future by modeling the tax impact of dying without a plan. We referred to our approach as “killing people on paper” or “killing them with paper” because if you weren’t dead, seeing the impact of taxes might be enough to kill you. At that point in time, the financial services industry was really product and sales driven, but we observed that the service, the consultation, and the education we provided were so much more valuable and important to clients than the sale of financial products. Not many advisors were offering robust financial planning services and very few were taking the time to educate clients and help them understand and gain comfort with their financial decisions and with their retirement plans.

In those days, you didn’t have sophisticated risk management and data analysis tools or software programs like we have today. How did you create financial plans back then?

There was a lot of manual number crunching. In the early 1970s, Texas Instruments came out with the very first handheld, electronic slide rule calculator, the SR-10. It cost $110 new, but my uncle, Warren Ozanne, was an engineer with Texas Instruments and was able to get one for me with his employee discount for only $90. In 1984, I was able to purchase an IBM desktop PC computer that used a floppy disc. I purchased a robust (at the time) financial planning software program from Lumens Systems which did a pretty good job of creating simple financial plans. Once the data was entered, I found it was convenient to schedule lunch shortly thereafter to let the computer run the calculations while I was away. We didn’t have the processing speed that today’s computers have.

You founded Probity Advisors, Inc. in 2002. Can you describe what led you to start another company in your mid-50s?

Over the years, our business had evolved from an insurance company, to a financial planning practice, to a comprehensive wealth management firm. Founding Probity was the next natural evolution that was really born out of necessity. At the request of many clients, I had already begun building individual stock portfolios and was managing assets on a discretionary, fee-only basis. There was demand from clients to provide ongoing advice and oversight in conjunction with my planning services.

From L to R: Adam Bronson, Buddy Ozanne, Christopher Sorrow, Tyler Ozanne

By 2002, I was working 16-hour days during the week, a full day on Saturdays, and then four or five hours Sunday afternoons. I would meet with clients during normal business hours and spend evenings doing company research and making trades. I’d then spend Saturdays and Sundays doing administrative work and preparing for the coming week. I realized that I would have to hire help or pare back the number of clients I served. Initially, I thought about outsourcing the investment management, which would have provided immediate capacity, but I was wary of losing control over the client’s overall experience. Instead, I chose to invest and grow in a way that would deliver on the client experience I envisioned. The timing on the one hand could not have been worse. I started interviewing in the midst of the dot com bust. On the other hand, as a small business, it allowed me to interview a great deal of talent who were hungry to be a part of building something. As you might expect, I chose to recruit from my alma mater, SMU, and I hired Christopher Sorrow and Adam Bronson in 2002. My younger son, Tyler Ozanne, joined the firm in 2003.

Your legal name is Porter Louis Ozanne, III. How did you get your nickname Buddy?

In 1948, the year I was born, legal names were used on bank accounts instead of account numbers or Social Security Numbers, and given there were three generations of Porter Louis Ozannes, the bank needed a way to keep the accounts straight. My aunt gave me the moniker.

What was the best decision you’ve ever made?

That’s easy. Marrying my wife Linda. We met in July 1973 and were married two months later. I definitely married up, and we will celebrate 48 years of wedded bliss this September. I always tell people that it’s a good thing we got married so quickly because Linda may have changed her mind if we waited any longer.

When you are not in the office, what do you enjoy doing?

Linda and I are avid SMU sports fans, primarily football and basketball. I also love golf, fly fishing, travel, and flying.

When did you develop a passion for flying?

I’ve always wanted to be a pilot. In college, I earned the highest possible score on an aptitude test issued by the Navy for their aviation program. In my senior year, the Navy offered me a commission to report to the naval base in Pensacola upon graduation for primary flight training. However, I needed an additional semester to earn the credits required to graduate. When the Navy couldn’t grant a deferral, I was disappointed that I wouldn’t be serving my country flying A-7s. I never let go of my dream of flying so I earned my pilot’s license in 1974 (perhaps to the dismay of some of my future passengers).

A newspaper article with a photo hangs in your office showing you and another person in an emergency rescue boat being ferried across a river with a scene of a plane crash in the background. What happened?

I piloted a small plane to visit clients across the Southwest and the Midwest in the 1970s and 1980s, counseling business owners and employees on pension plans and other aspects of financial planning. In 1981, a colleague and I were on a return flight from Austin to Dallas following a client meeting. I was anxious to get home to fulfill my promise to Linda that I would make it back in time for our tickets to see the musical, My Fair Lady, which I was not too excited about. A mechanical malfunction caused the loss of the right engine. I communicated with air traffic control and received instructions to circle back for an emergency landing at the same runway where we had taken off when the second engine went quiet, and we began losing altitude. I told the control tower that we wouldn’t make it back to the airport. They advised us to land on a road about a half a mile away, but since we were still in the clouds, we couldn’t see the road. We lost radio contact with the control tower and broke through the clouds with less than a minute to find a place to land. I saw a sorghum field and banked to the right to line up parallel with the plowed fields as they taught us in flight school. I landed the plane with my passenger and I both safe and unharmed, except for maybe my pride. My passenger joked that I would do anything to get out of going to the theater.

Surprisingly, that was not your first in-flight emergency. There was another?

In the late 1970s, my father, stepmother, and I were flying a twin-engine Piper Aztec on the way to see my brother graduate from the Marine Corps Training Center at Twentynine Palms near San Diego, CA. My father was piloting the plane when a massive wind shear over a canyon disrupted airflow over the wings and forced the plane into a full stall. Fortunately, my father managed to pull the plan out of its descent by pushing the nose down and increasing the engine power using the throttle. When the aircraft’s speed increased, he was able to level the wings and pull up to return the aircraft to normal flight. Once we were out of danger, I took over the controls and could tell something wasn’t right and landed the plane in El Paso. After I kissed the ground, we inspected the exterior of the plane and saw that the force of the wind caused irreparable damage to the wings. An insurance agent totaled the plane the next day, and we caught a commercial flight to San Diego and made it to the graduation.

What was going through your mind during the in-flight emergency?

I was thinking how relieved I was that I had just renewed a life insurance policy for Linda and our infant son.

You’ve often said you are not a very good golfer, but can you tell us more about the two hole-in-ones you’ve made?

One was a perfect 5 iron into a pretty strong headwind, 165 yards to hole #9 at Northwood Club. The second was a perfect 5 iron shot on #12. The pin was placed behind the sand trap on the right front of the green, so it was a “blind” shot. When I arrived at the green, I didn’t see my ball and nervously peered into the hole, and lo and behold, there it was.

You spend a lot of your time in service to others. What are some of the organizations you’ve served?

I spent nine years as treasurer of the Highland Park Educational Foundation. My family is very active in our church where I’ve served as president of the Board of Trustees, choir member, Sunday school teacher, and First Reader. I was a past president of the Board of Directors for our church-sponsored nursing home. I’ve served on the Board of Directors of the Principle Foundation, a nonprofit located in Kansas City, Missouri. I am very involved in SMU and serve on The Associates Board of the Cox School of Business where I get to meet with and mentor students. I truly enjoy mentoring and helping the next generation. I currently serve as a board member of the Mustang Club and was president of the SMU Dad’s Club when Tyler was there.

In your opinion, what does it take to be a successful advisor?

Genuine and deep-rooted care for others and the ability to listen. Also, the perspicacity to assimilate disparate bits of information and quickly form an opinion.

It sounds like your English professor aptly described you. Do you have any words of wisdom that you’d like share with those who have read this far?

Spend less than you make. Do the right thing. Resolve to do your best every day.

All who have been blessed to know Buddy are thrilled to see him accomplish this tremendous milestone, and we cannot wait to celebrate his golden anniversary in person when we can safely gather.

Important Disclosure: The information contained in this presentation is for informational purposes only. The content may contain statements or opinions related to financial matters but is not intended to constitute individualized investment advice as contemplated by the Investment Advisors Act of 1940, unless a written advisory agreement has been executed with the recipient. This information should not be regarded as an offer to sell or as a solicitation of an offer to buy any securities, futures, options, loans, investment products, or other financial products or services. The information contained in this presentation is based on data gathered from a variety of sources which we believe to be reliable. It is not guaranteed as to its accuracy, does not purport to be complete, and is not intended to be the sole basis for any investment decisions. All references made to investment or portfolio performance are based on historical data. Past performance may or may not accurately reflect future realized performance. Securities discussed in this report are not FDIC Insured, may lose value, and do not constitute a bank guarantee. Investors should carefully consider their personal financial picture, in consultation with their investment advisor, prior to engaging in any investment action discussed in this report. This report may be used in one on one discussions between clients (or potential clients) and their investment advisor representative, but it is not intended for third-party or unauthorized redistribution. The research and opinions expressed herein are time sensitive in nature and may change without additional notice.