February 28, 2020

Growing concerns over the novel coronavirus spreading in the U.S. sparked a sharp sell-off on Wall Street this week with the S&P 500 shedding 11.50%. This was a sensational move given that we were near all-time highs just last Friday. The selloff has been driven by reports of the first unknown origin case of coronavirus in northern California, suggesting a possible domestic “community spread” of the disease in the U.S. Due to the growing concerns over coronavirus and the potential impact to client portfolios, we are breaking from our standard week in the markets commentary to bring you this special note outlining our current thoughts on the potential fallout from a coronavirus pandemic. It’s always difficult to address our clients and friends following the type of shellacking markets experienced this week. The difficulty lies partly in knowing the anxiety and consternation it causes even the most disciplined of our investors to see their portfolio values plummet in a mere matter of days. While the path of this epidemic has yet to be determined, and indeed remains unknowable, our research team has been hard at work studying the impact of past epidemics and market declines to help forecast market recoveries and the impact to your portfolio.

What is Coronavirus?

Coronavirus or COVID-19, its formal name, was discovered in central China when the virus first popped up in December in the Wuhan province. The outbreak was detected after a cluster of cases of pneumonia of unknown origin were reported to the China National Health Commission. Although early reports suggested a seafood market was ground zero for the outbreak, researchers now believe there could be multiple sources of origin. Until recently, markets had been using the 2003 SARS epidemic as its impact model, assuming, like SARS, the virus would be safely contained to China and Asia generally. COVID-19 has proved more difficult to detect as the virus has managed to spread beyond Asia, making it increasingly look like a global pandemic. The rapid spread of the virus has spread in part by the fact that it can be transmitted by non-symptomatic or lightly symptomatic infected individuals. There is no cure or vaccine presently, although major drugmakers such as Moderna, Gilead, Sanofi, and Johnson and Johnson are working on clinical trials to treat the virus.

Coronavirus by the Numbers

The early outbreak of the coronavirus in China has given scientists an opportunity to learn more about the disease. According to the medical journal JAMA, which released a paper this week on 72,314 coronavirus cases in China, the overall case-fatality rate was 2.30%. About 80% of individuals which contract the virus have mild to severe cases. Fatality rates vary widely among individuals who contract the disease. For those 9 years and under, no deaths occurred. It is believed that the four different coronavirus strains that cause the common cold help kids better battle the virus strain as they get colds more often, boosting their virus fighting ability. The virus fighting ability wears off as older individuals contract colds less often. Fatality rates are primarily concentrated in individuals aged 70 to 79 years as 8% succumb to the virus, while those aged 80 years and older have a fatality rate of 14.80%. Older individuals who succumb to the disease often had preexisting conditions such as cardiovascular disease, diabetes, chronic respiratory disease, hypertension, or cancer. Although coronavirus is highly contagious, the prognosis for the average healthy individual who is stricken by the virus is good.

A Look at Past Epidemics and Markets

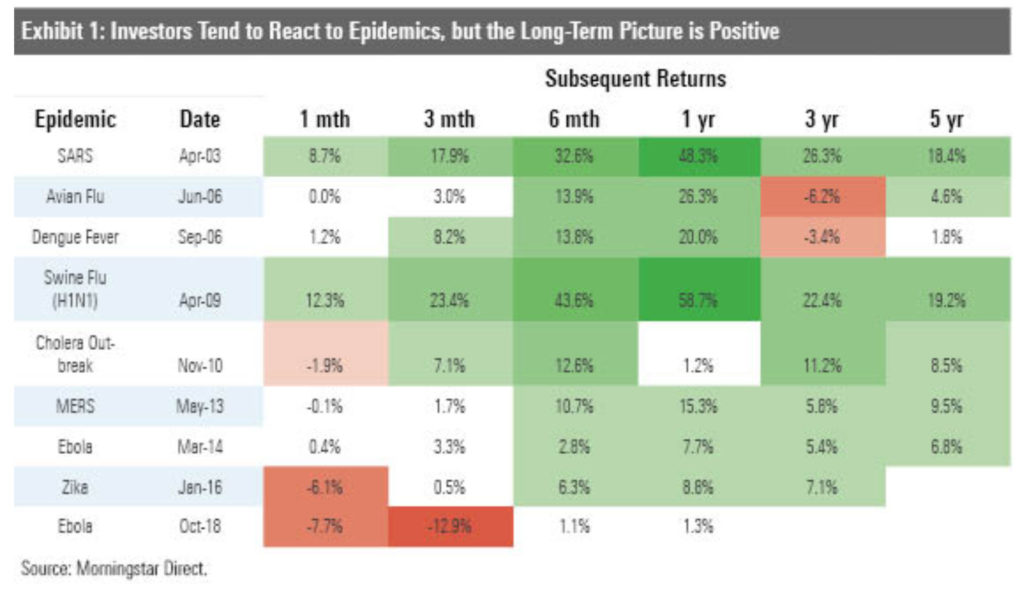

Epidemics represent a unique challenge to a tightly tethered economy because they come as shocks. Unlike business cycle recessions, where conditions tend to deteriorate over time, shock events lead to a sudden change in supply or demand, resulting in a rapid repricing of valuations by markets. The past is certainly not necessarily a predictor of future results, and COVID-19 is clearly an outlier from what we can tell so far, but history still serves as an important guide when it seems there are no answers. To assess the market’s reaction to past outbreaks, we consulted Morningstar, an independent research firm. Morningstar scanned the archives and found nine instances of modern epidemics and the corresponding market declines. They calculated the market’s subsequent return one month, three months, six months, one year, three years and five years following the event. With the exception of those measurement periods that happen to also coincide with the Great Recession, the recovery from these events are favorable to long-term investors. The chart below provides greater details on their findings.

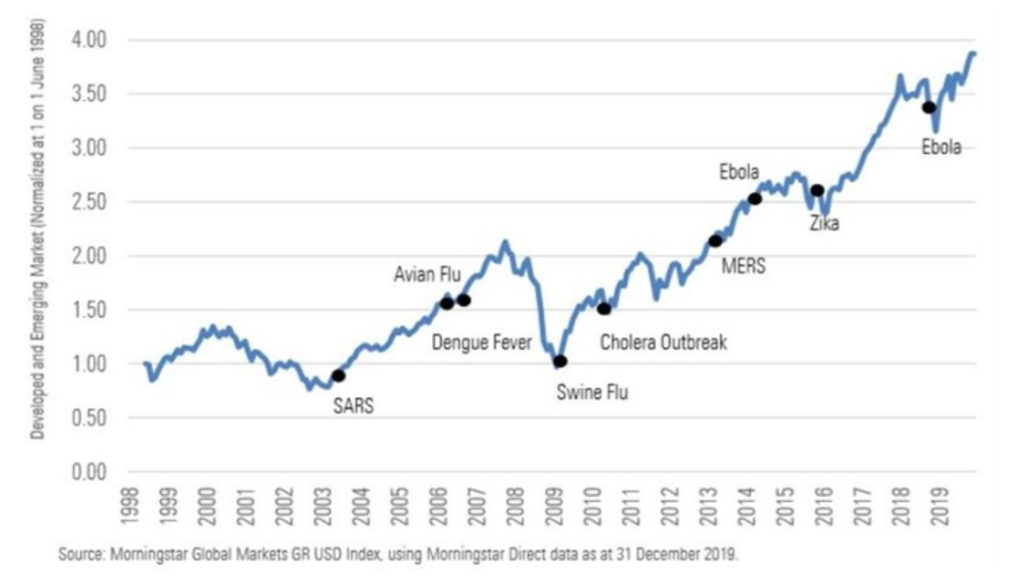

Using a longer focal length, epidemics fail to change the ultimate trajectory for markets. The chart below is from Morningstar, superimposing the same nine epidemic events on the Morningstar Global Markets Gross Return Index from 1998 to present. In cases where you see sharp sell offs, the chart validates the overreaction and rebound — at least historically speaking.

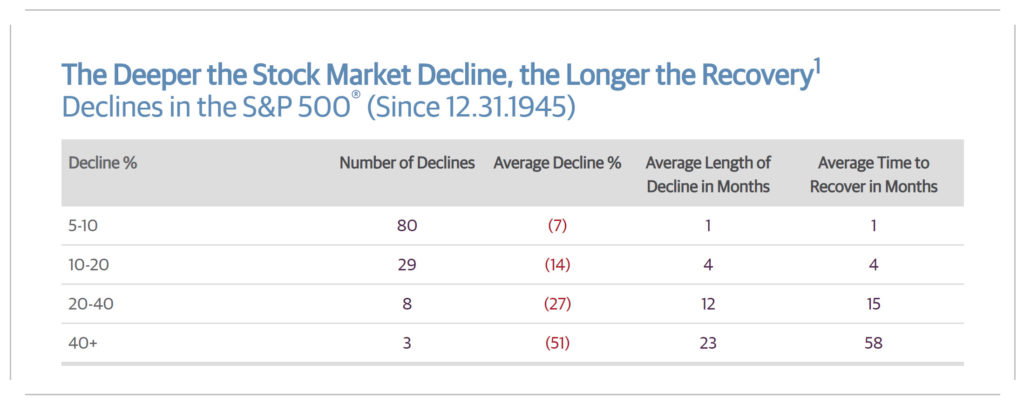

If we take epidemics out of the mix, and just focus on corrections, a market decline of greater than 10% from its previous peak, these events occur much more frequently than we tend to remember. The following research was published by Guggenheim Funds, who looked at market pullbacks of the S&P 500 since 1946. They found that market corrections with declines between 10% and 20% happen about every 2 1/2 years on average. More importantly, moves of this magnitude tend to decline an average of 13.30%, with an average recovery period of 4 months.

In Times of Panic, Go Back to Economic Fundamentals and the Federal Reserve

There is no doubt that headlines reporting that the virus had spread this week were unnerving, but the reaction now seems to have priced in a worst-case scenario for corporate earnings for 2020. This week, while markets were in turmoil, the Atlanta Fed released its most recent forecast on GDP. Their February 28th GDPNow forecast calls for a 2.60% increase in Q1 2020 GDP growth, and provided consumers do not succumb to the fear of the coronavirus and pull back on spending, strong jobs growth and healthy wages should keep demand up to help support that. The point is that the market is looking ahead not really knowing what the outcome will be, and while concerns are rising over the virus becoming a domestic reality, there is reason to believe that the supply chains and inventory shortages that the market is fearing will be less than expected. To begin with, manufacturing and trade inventory data from February 14th showed inventory levels at near term highs. Retailers for the first half of the year have already placed their orders and those goods are either in the water or have reached stores. A more encouraging sign is that Chinese factories are beginning to come back online which should help alleviate bottlenecks for U.S. manufacturers. Still, we acknowledge the supply chain problem for manufacturers is likely to be a headache for some time. With this week’s sell-off, valuations are more reasonable. Assuming no earnings growth in the S&P 500, the index is trading at roughly 18x earnings. If the earnings growth rate increases to 6%, it brings the multiple down to 16.8x. Prior to the sell-off, analysts had anticipated between a 7-10% in earnings growth and were willing to pay 19x earnings to do so. If there is a silver lining it is that the degree of overvaluation we have been experiencing has been stripped out and we should be on firmer ground from a valuation standpoint. Furthermore, it is likely we are going to see some combination of fiscal and additional monetary stimulus which will help backstop markets.

Although it may be of small solace to anyone having just experienced the worst one week performance since the Financial Crisis, the fact is that history is on the side of those who remain invested through times of panic. Just how big a factor COVID-19 will be for markets in the short run is entirely unknowable. We acknowledge the challenges to the economy and earnings, but believe those who remain steadfast will be rewarded. At some point, investing all comes down to conviction, and this was summed up best in a quote from Ken Langone, co-founder of Home Depot. When asked about the potential risks of the coronavirus, he responded, “Don’t let your emotions run away with you. Don’t give up on America and don’t give up on the world. It’s not that time.” We agree. It’s not that time.

The Week Ahead

Markets will attempt to rebound from this week’s poor showing with the latest reports on jobs and manufacturing.