Bulls Hit Pause to Assess Coronanomics

February 21, 2020

After leading the S&P 500 to two consecutive weeks of gains and all-time record highs, bulls hit pause on their record-setting run this week to take stock of “coronanomics”. Until just recently, investors had been encouraged by the steps taken in China to contain the virus, and the assurance of monetary and fiscal stimulus measures offered to combat the potential loss of economic output from global central banks. With the virus continuing to spread and new hotspots emerging in South Korea, Japan, and Iran, investors are growing increasingly anxious that the global economy could take an even larger hit in Q1 2020 than markets had been prepared for. It didn’t help that U.S. economic news was relatively light this week giving investors little else to focus on. The housing market posted mixed results while producer price inflation remaining muted. For the week, the S&P 500 fell 1.25%.

Building Permits Point to Sustained Housing Market Strength

Data on homebuilding was mixed as building permits surged while housing starts slipped in January. Building permits soared 9.20% to a rate of 1.551 million units in January, a near 13-year high. Gains in both single and multi-family housing helped drive permit growth. Meanwhile, housing starts fell 3.60% to an annual rate of 1.567 million units last month. Markets largely dismissed the dip as December’s homebuilding activity was upwardly revised to a pace of 1.626 million units, their highest level since December 2006 and higher than the 1.608 million units previously reported. Homebuilding activity remains healthy, supported by healthy building permit growth and low mortgage rates.

Existing Home Sales Fall on Tight Supply

Existing home sales fell 1.30% in January to a seasonally adjusted annual rate of 5.46 million units. Inventory remained tight at 3.1 months, down from 3.8 months of supply in the year ago period. January’s figure is significantly lower than the six to seven months of supply which is considered a healthy balance between supply and demand. The lack of supply continued to put upward pressure on prices, with the median home price rising 6.80% year-over-year to $266,300. New homebuilding activity should help increase the supply of homes on the market overall and relieve some price pressures in the existing home sales market in the coming months.

Producer Price Inflation Remains Modest

Producer prices rose 0.50% in January, following a 0.20% increase in December. The January increase was driven by the inflating cost of services such as healthcare and hotel accommodations. Despite January’s jump, producer prices were only 2.10% higher from the year ago period. Core prices, which exclude the volatile food, energy, and trade services components, rose 0.40% in January. That followed a 0.20% increase in December. On a year-over-year basis, however, core producer prices were up just a mere 1.50%. The outlook for producer prices remains very tame as the spillover effects of the coronavirus is set to keep a lid on global demand and prices.

Watching the markets this week you get the sense that something has to give. Equities remain near record levels with the S&P 500 and Nasdaq jumping to all-time highs on Wednesday, while yields on safe havens like the 30-year Treasury bond broke all-time lows and gold soared to levels not seen in 7 years on Friday. Investors have been modeling their expectations for Covid-19, the official name for the current coronavirus strain, based on their previous experience with SARs. While SARs inflicted a substantial economic toll at the time, it was generally a short-lived event. Using that as their model, investors have put their concerns on the back burner, but Covid-19 now looks as if it will be harder to predict than first thought. Apple warned this week that supply chain disruptions would impact their iPhone sales, and nearly half the companies reporting earnings have indicated the virus will have some drag on their profits in Q1. Fears over the coronavirus have already materialized with IHS Markit’s aggregate measure of business activity in the services and manufacturing sectors dropping from a respectable 53.3 in January to 49.6 in February. This trend in the data is likely to accelerate as it is, and if it continues to do so while the virus is still accelerating beyond China, investors should be prepared for some volatility.

The Week Ahead

It’s a light week for economic news with international trade and durable goods orders on tap.

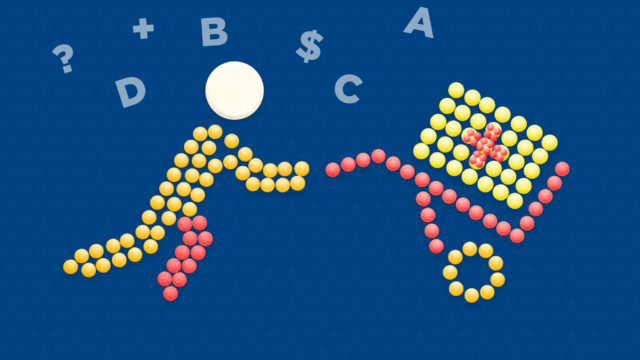

Making Sense of Medicare

Given that we are in an election year, there has been a lot of attention on the healthcare policies of presidential contenders. Medicare in particular took center stage at this week’s Democratic debate in Nevada. The topic is expected to continue to play a major role in this year’s presidential race. Our advisors regularly counsel clients on how to forecast healthcare costs in retirement and on understanding how Medicare works. Medicare is the federal health care program for people aged 65 and older and some individuals with disabilities. One of our advisors, Tyler Ozanne, shared that, “Many clients who are nearing retirement and beginning to contemplate Medicare are surprised to discover that it isn’t free and that it doesn’t cover everything. Enrollees pay premiums, copays, and deductibles.” Tyler added that higher-income earners pay more, and there is no out-of-pocket maximum. Our advisors spend a lot of time educating clients about what Medicare does and does not cover. Tyler added that education is so critical in the planning work we do with clients. To that end, we’ve provided an overview of Medicare below. This is not comprehensive, and we urge you to meet with your advisor to discuss your unique circumstances.

Original Medicare consists of two parts: Part A and Part B. Most eligible individuals are automatically entitled to Part A because they or their spouse paid Medicare payroll taxes for at least ten years. Part A provides coverage for hospital stays, skilled nursing, hospice, and some home health services. There is no premium for Part A, however, it comes with a deductible of $1,408 in 2020 per benefit period and has some caps on benefits.

Part B covers doctor visits and other outpatient services and medical equipment, such as flu shots, crutches, or blood sugar monitors. The monthly premium individuals pay for Part B is $144.60 or higher, depending on your income. It also comes with a $198 deductible in 2020. Parts A & B do not cover prescription drugs.

Part D is an optional prescription drug benefit. The national average monthly premium for Part D is $32.74 in 2020. Higher earners may pay up to an additional $12.20 to $76.40 per month for this benefit. The deductible for 2020 may be as high as $435.

Medicare Part C, known as Medicare Advantage, includes both Parts A and B. It is offered by private insurance companies approved by Medicare. Enrollees usually pay a separate monthly premium for Part C, which is used to cover a wider range of services. Part C plans typically provide prescription drug coverage and other types of benefits like dental and vision.

Medicare Supplement Insurance (Medigap) helps pay some of the out-of-pocket health care costs that Original Medicare doesn’t cover, including copayments, coinsurance, and deductibles. Private companies sell the policies.

Late Enrollment Penalties

If an enrollee does not sign up for drug coverage and wants to add it later, they may pay a penalty of higher premiums for the rest of their lives. Additionally, if an individual who turns age 65 and hasn’t tapped into their Social Security yet — which triggers enrollment in original Medicare — and if they miss their enrollment period, they may also face life-lasting penalties. The enrollment period begins three months before you turn 65 and ends three months after. If you have insurance through an employer when you reach age 65, you may be able to delay signing up for Medicare with no penalties.

If you have questions about Medicare, please do not hesitate to reach out to one of our advisors who can help you navigate your choices and discuss ways to protect yourself from potential pitfalls when choosing a plan.